vanguard intermediate term tax exempt bond index fund

Spanning the entire spectrum of fixed income opportunities. For additional financial information on Vanguard Marketing Corporation see its Statement of Financial Condition.

![]()

7 Best Vanguard Bond Etfs For Your Portfolio 2022 Review Investor Impact Lab

Vanguard Intermediate-Term Tax-Exempt Fund seeks to provide amoderate and sustainable level of current income that is exempt from federal personal income taxes.

. Vanguard Intermediate-Term Tax-Exempt Fund seeks to provide a moderate and sustainable level of current income that is exempt from federal personal income taxes. XNAS quote with Morningstars data and independent analysis. At least 75 of.

View mutual fund news mutual fund market and mutual fund interest rates. Stay up to date with the current NAV star rating asset allocation. Find the latest Vanguard Interm-Term Bond Index Inv VBIIX.

Ad Access the investable global fixed income universe from any angle. The fund is often recommended see Fig. Spanning the entire spectrum of fixed income opportunities.

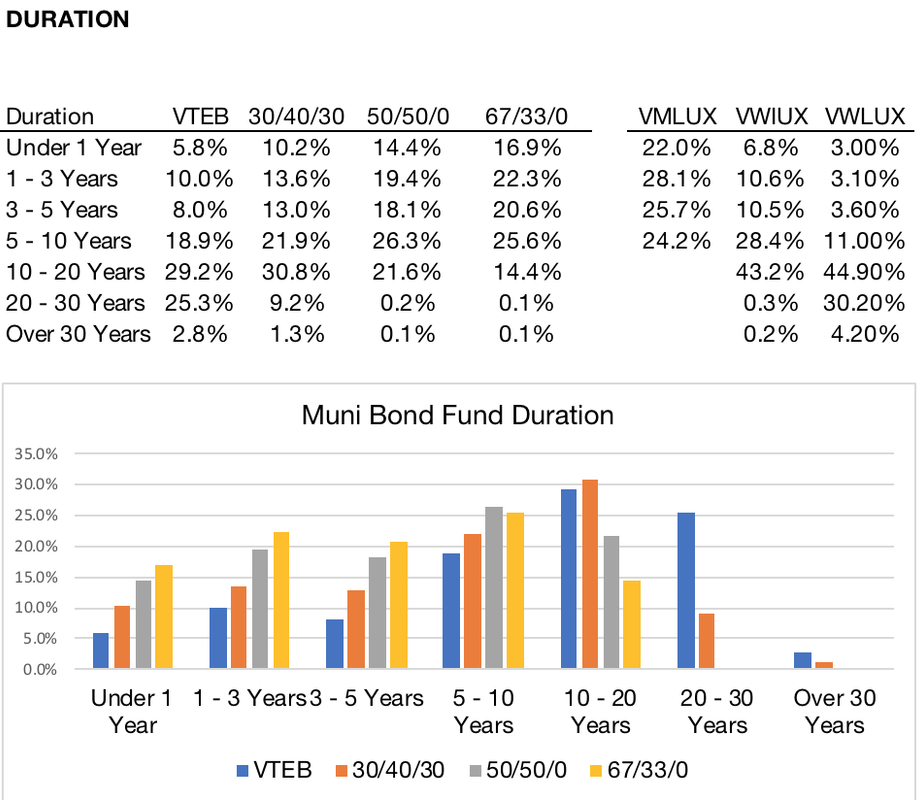

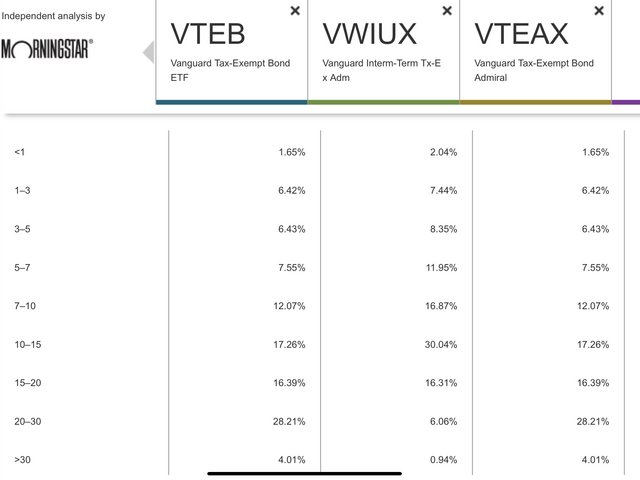

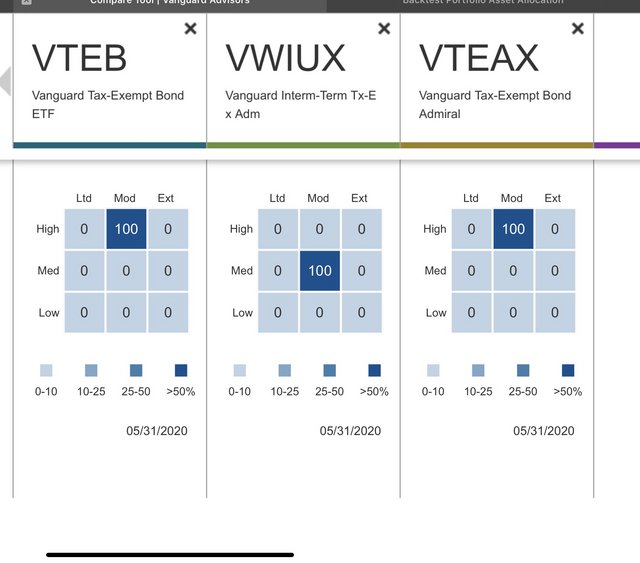

VWIUX A complete Vanguard Intermediate-Term Tax-Exempt FundAdmiral mutual. 1 as a core holding in a simple three-fund or four-fund portfolio especially by investors who do not want to hold mortgage securities 1 in a bond allocation. The Fund seeks to track the performance of a market-weighted bond index with an intermediate-term dollar-weighted average maturity.

Vanguard Tax-Exempt Bond Fund has an expense ratio of 009 percent. Fees are Low compared to funds in the same category. The income is expected to be exempt from both federal and California personal income taxes.

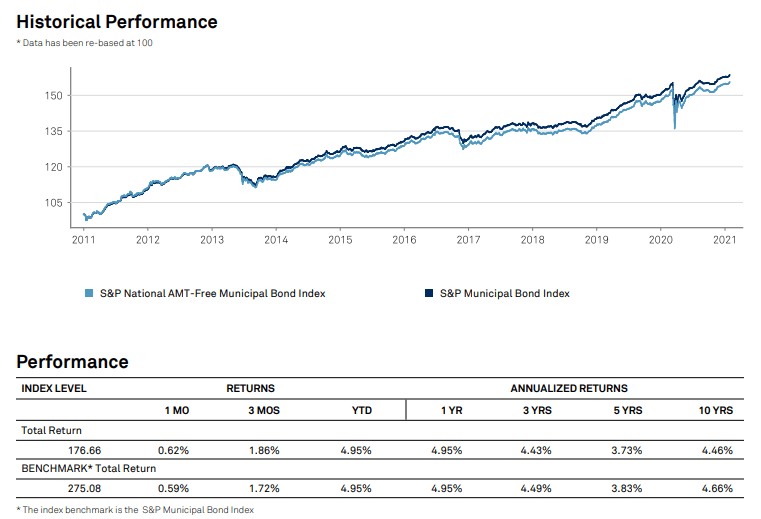

In most common circumstances at least 80 of this funds assets will be invested in securities where the income will be exempt from federal income taxes and the federal alternative minimum tax. Vanguard Tax-Exempt Bond Index This fund could be ideal if youre looking for a bond index fund that provides broad diversification and tax efficiency. About Vanguard Tax-Exempt Bond ETF The investment seeks to track the Standard Poors National AMT-Free Municipal Bond Index which measures the performance of the investment-grade segment of the.

The fund has no limitations on the maturity of individual securities but is expected to maintain a dollar-weighted average maturity of 6 to 12 years. The fund is intended for California residents only. Ad Access the investable global fixed income universe from any angle.

While other tools may compare funds only to the SP 500 or 500 Index fund you can use this tool to determine how closely the performance of one Vanguard stock fund tracks that of any other Vanguard stock fund. Vanguard Intermediate-TermTax-Exempt Fund Investor Shares Return BeforeTaxes 110 373 327 Return AfterTaxes on Distributions 107 373 327 Return AfterTaxes on Distributions and Sale of Fund Shares 151 347 317 Vanguard Intermediate-TermTax-Exempt Fund Admiral Shares Return BeforeTaxes 118 382 336 Bloomberg 1-15Year Municipal Bond Index. January 31 2012 December 31 2021 13614 Fund as of 123121 13294 Benchmark as of 123121 Annual returns.

The Fund employs an indexing investment approach designed to. Benchmark Bloomberg 1-15 Year Municipal Index Growth of a 10000 investment. The Fund seeks to provide a higher level of current income than shorter-term bonds by investing primarily in high-quality municipal bonds issued by California state.

View mutual fund news mutual fund market and mutual fund interest rates. California Intermediate-Term Tax-Exempt Fund seeks to provide a higher level of current income than shorter-term bonds but with less share-price fluctuation than longer-term bonds. VWITX A complete Vanguard Intermediate-Term Tax-Exempt FundInvestor mutual fund overview by MarketWatch.

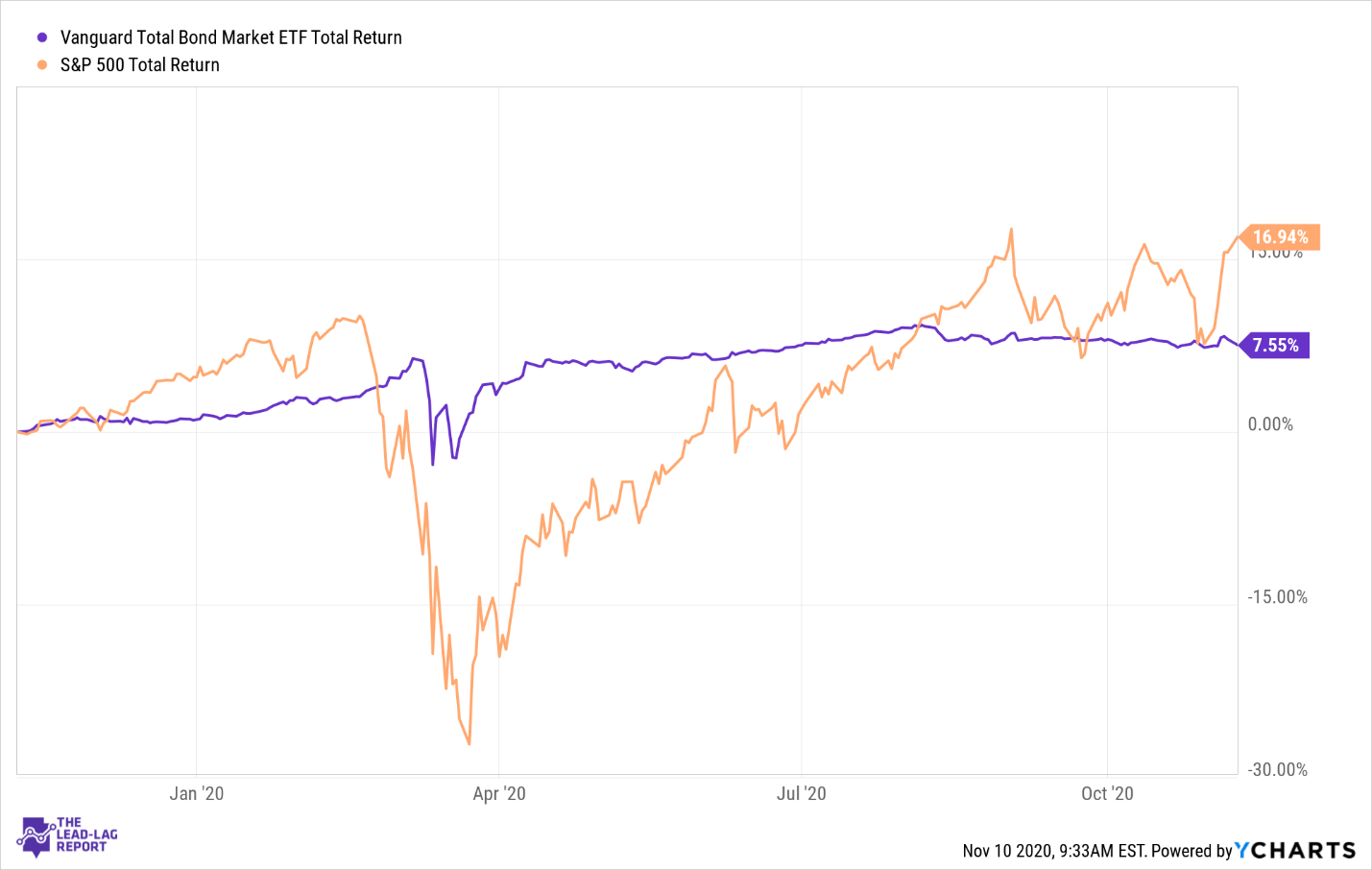

Compare all the funds that you own. To diversify look for funds that have low correlation with one another. The Vanguard Intermediate Term Bond Index Fund is usually considered a candidate for placement in tax advantaged accounts.

Brokerage assets are held by Vanguard Brokerage Services a division of Vanguard Marketing Corporation member FINRA and SIPC.

Top 10 Best Tax Free Municipal Bond Mutual Funds

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

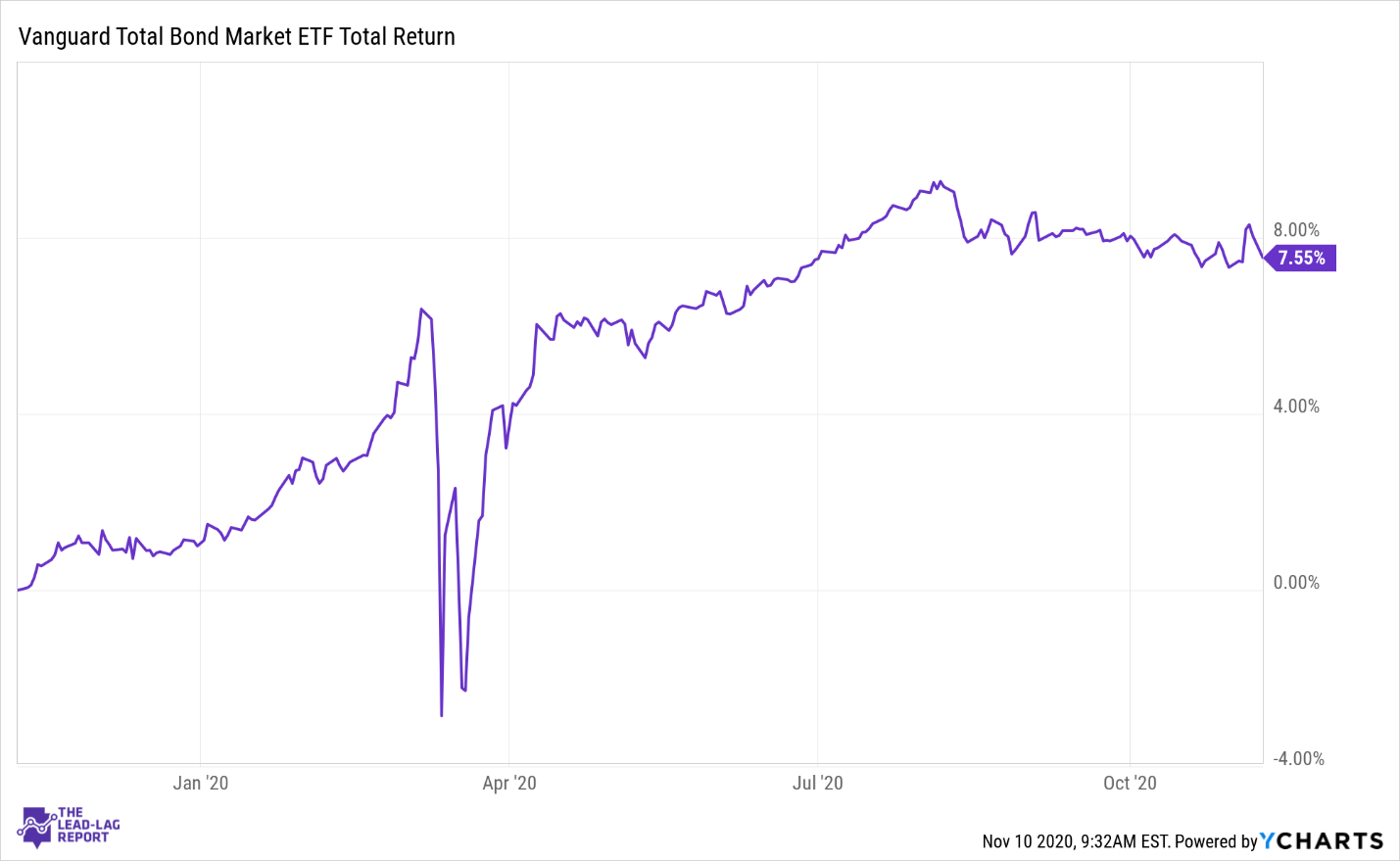

Vanguard Total Bond Market Etf A Good Return In Safe Hands Nasdaq Bnd Seeking Alpha

Should I Bother With Tax Exempt Bond Bogleheads Org

Our Approach To Tax Exempt Portfolio Allocation Seeking Alpha

Vwitx Vanguard Intermediate Term Tax Exempt Fund Investor Shares Vanguard Advisors

2 Questions About Vanguard S Tax Exempt Bond Index Bogleheads Org

2 Questions About Vanguard S Tax Exempt Bond Index Bogleheads Org

Vteax Vanguard Tax Exempt Bond Index Fund Admiral Shares Portfolio Holdings Aum 13f 13g

Municipal Bond Yields A Renaissance Of Tax Exempt Income

Vanguard Total Bond Market Index Fund Tax Distributions Bogleheads

Vteax Vanguard Tax Exempt Bond Index Fund Admiral Shares Vanguard Advisors

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

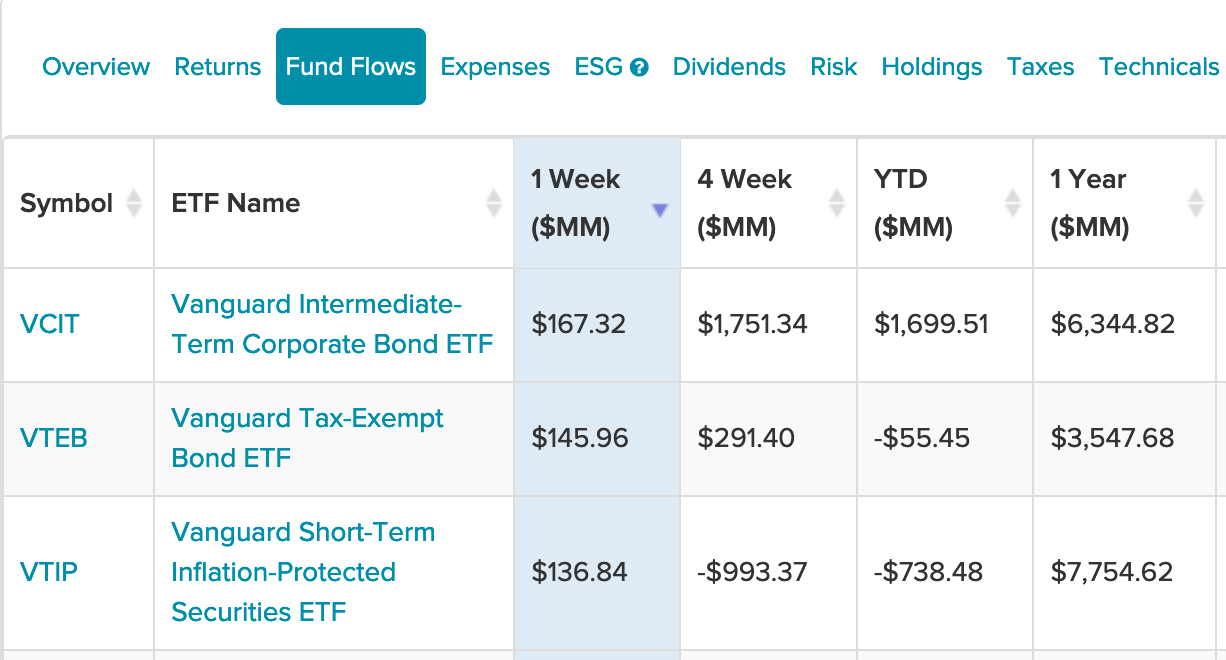

What The Past Week S Inflows For Vanguard S Bond Etfs Are Saying

Vanguard Total Bond Market Etf A Good Return In Safe Hands Nasdaq Bnd Seeking Alpha